Financial services onboarding

white-label customer onboarding for financial institutions

Snaprove™ is a white-label and fully customizable solution that offers all the major technologies and features to verify your customers and to gather information in a single detailed customer file. Bank grade security and sophisticated encryption, we make sure your data never falls into wrong hands.

Thanks to our combined knowledge in financial services onboarding and expertise in compliance, we provide you the supporting documents needed to obtain your country’s regulators approval to use our solution. In accordance with your IT and compliance needs, - such as AML/KYC and due diligence regulatory requirements - we will define a workflow together.

We offer a flexible set of tools for financial services onboarding such as an SDK, Web app and Mobile apps for all platforms. Our solution is easy and secure to integrate server to server, and does not require any changes in core banking or CRM systems.

We provide Internet User Experience (IUX) advice in order to create a seamless experience for your customers.

Following your digital plan, it only takes 4 weeks to get a fully functional prototype.

Our features

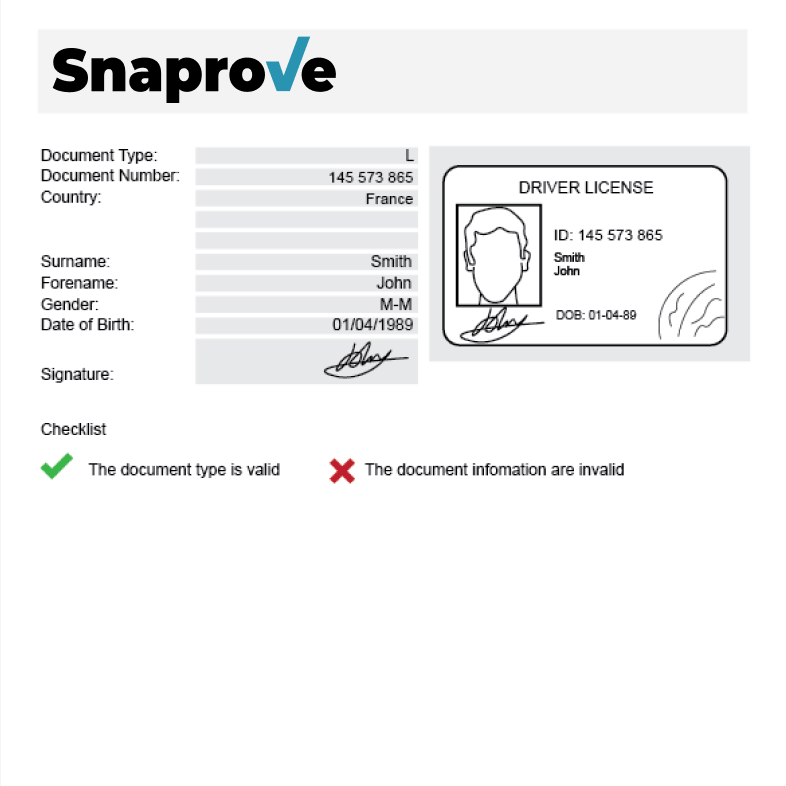

ID Verification

Snaprove™ verifies the authenticity of the ID documents and improves fraud protection. The solution accelerates the identification process as the customer simply scans the ID documents with their phone. This process is quick and intuitive, creating a seamless user experience.

- The customer scans the recto and the verso of his IDs, passport or driving license.

- Security elements such as holograms, the MRZ, micro prints and image pattern are checked.

- If the ID is validated, the user proceeds to the next step.

Biometric Identification

The biometric facial recognition algorithms allows the comparison between the customer selfie and the identity document photo in order to check if the person who is applying is the person in front of the screen. Snaprove™ uses multilayer biometrics, computer vision and AI technologies to ensure the process is secure and reduce false positives.

- The customer takes a selfie of himself.

- Snaprove™ verifies the similarity of the face and the liveness of the person.

KYC due diligence

Thanks to its scanning tool, Snaprove™ checks the potential implications of the user into money-laundering and terrorist activities and performs other checks required by AML/KYC regulations via a database search powered by Thomson Reuters. The real-time instant checks allow the identification of high risk customers, and for informed decisions to be made faster and decrease reputational damage due to AML issues.

- Customer details are scanned and Snaprove™ checks for a profile matching the user applying.

Phone and email verification and risk scoring

For increased security during the identity verification, Snaprove™ checks the email address or the phone number of the user against blacklists to verify whether it is connected with suspicious activities. A risk score is assigned based on that.

- Customer details are scanned and Snaprove™ checks for a profile matching the user applying.

Additional document upload

According to the financial industry needs, you can choose to require the user to upload specific documents in a few minutes. Thanks to our technology, we can check additional information such as the address, the employment of the user or others by supporting proof of address and proof of employment gathering and verification.

- The customer manually enters his residential address with predictive results.

- The user scans the proof of residential address and uploads it. We check the name, address and other details of the document.

Digital signature

The digital signature option asks the customer to review and then electronically sign a number of documents. It can be a simple signature or an advanced electronic signature. Thanks to digital signatures, customers can sign anywhere and anytime as they carry the same legal weight as graphic signatures.

- The customer can sign by checking a box or by receiving a one time password (OTP) to electronically sign the document.

Video identification call

In some countries, regulators require video-based online identification for opening online accounts. During our video identity verification process (mobile or desktop), we check the validity of ID documents and authenticate the user. The use of video conferencing provides a seamless experience and a reliable identity verification compliant with all AML/KYC requirements.

- The user joins the video call through his mobile device or desktop and our identification expert asks to show the customer’s ID document and face to proceed with the verification.